Your financial well-being and plans for the future can be impacted by various economic events, so below is a video to assist you to stay up to date with the latest indicators.

Slowing global growth and ongoing trade tensions were major concerns in October. Global stocks had a positive month on signs of a breakthrough in trade negotiations between the US and China.

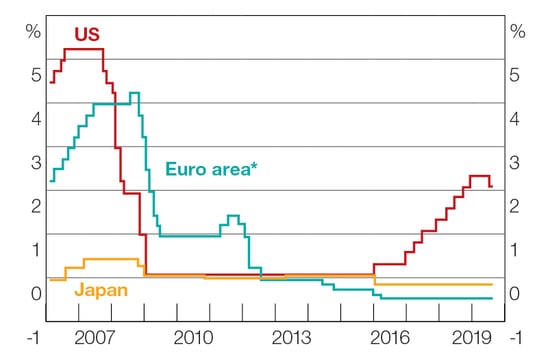

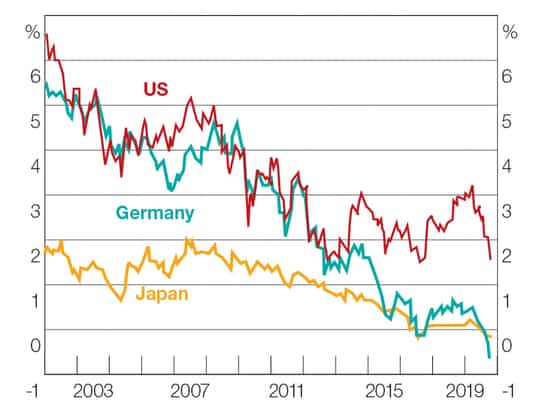

The cash rate was held at the current record low of 0.75%.

Current low interest rates appear to be supporting a gentle turn around in economic growth. This is evidenced by a rise in the September quarter inflation figure and a slight easing in the unemployment rate.

We also look at the other economic indicators that paint a picture of the health of the economy, including consumer sentiment, movements in the Australian dollar, unemployment and wages as well as the state of the property market across all of the capital cities.

If you have any questions or want to have chat about how the latest economic developments are impacting your financial situation feel free to give us a call.